The core mission of Real Estate Investor Goddesses is to help women achieve financial independence through passive income in real estate. On Financial Freedom Day, Monick Halm expounds on that mission and the rationale behind it. The gender wealth gap is as real as ever, and even more strikingly so for women of color. As a woman of color herself, Monick is passionate about helping other women create generational wealth through real estate. Opportunities for women in real estate abound out there; it’s just a matter of getting them to realize that they are there and seize them. By empowering one woman at a time, she is helping multiple generations thrive on passive income, thus significantly increasing their chances for upward mobility and more fulfilling life.

—

Watch the episode here:

Listen to the podcast here:

Financial Independence For Women – The Real Estate Investor Goddesses Mission

Passive Income And Financial Freedom

We’re doing something a little different. First of all, I am doing this live in my Facebook group which is unusual and the other thing is I’m not interviewing anyone. I’m talking and I want to share a little bit about financial freedom and our mission about that here. July 1st is National Financial Freedom Day. Financial freedom is my mission. My mission is to help one million women create financial freedom through real estate investing. What does it mean? I was talking to a woman wanting to join our investor club and I asked her what was financial freedom for her if she has a different definition than what I have. My definition for financial freedom, what I’m hoping to help women achieve is having enough passive income streams that their passive income equals or exceeds their expenses.

Let’s say you have $5,000 a month of expenses. If you have $5,000 of passive income streams coming in, at that point, that would be financial freedom. You no longer have to trade your time for money in order to meet your expenses. Some people will think of that as financial independence and financial freedom is having the money to do whatever or whenever you want. It’s not maintaining your lifestyle but having the dream life that you want. I want that for you too. First things first, let’s get you to that level where you can maintain your lifestyle without having to work. Then from there, you can build so that your passive income can pay for the travels around the world and the private jet if that’s how you want to roll. For me, it’s to have your passive income equal or exceed your expenses.

Financial freedom is when your passive income equals or exceeds your expenses.

Why is that important to me? There are a few reasons why that’s more important. The main reason why I’m so committed to helping women to achieve that is that financial freedom does two things. First, it gives you time back. That is the one resource that we all have the same amount of that is limited to 24 hours a day, 365 days a year. Every second we spend, we don’t get that back. I realized this hit me so hard when my brother was first diagnosed with cancer and I was like, “He could die.” It hit me like, “He’s going to die. We’re all going to die.” Weirdly, that felt reassuring to me. I was like, “We are all going to die but we don’t all live. We only have the time we have. Let’s live fully while we’re here.”

Time is a precious thing and financial freedom gives you time because you no longer have to trade your time for money. That’s what passive income gives you. Your time is divorced from having to get money, so that frees you up. It also frees you from having to think about, “What do I have to do to keep the lights on, the roof over my head, the kids fed?” and all of that stuff. I find that when women, in particular, have more time and money, they give back to their families, communities, and the world. There have been a lot of studies that have shown that when you empower women financially and economically, you transform communities and you change lives for generations. Empowering one woman helps three generations at least. Helping women achieve financial freedom is a shortcut to helping everyone because the woman is going to take care of their kids. She’s going to bring her men, sisters, mama, aunties, brothers, uncles, and every one along. Helping women this way helps everyone in my opinion.

The Gender Wealth Gap

I’m also committed to financially empowering women because I want to erase the gender-wealth gap. For every dollar of net worth that a single man has in the United States, and when we talk about net worth, that is what you own, your assets, minus what you owe, your liabilities. Ultimately, there’s a lot of focus on income like how much people get paid for what they do but true wealth is about net worth. There’s already an income gap. For every dollar that a man makes, a woman only averages about $0.77.

When you look at net worth, that number is far worse for every dollar that a single man has that a single woman only has $0.23. That number gets much worse when you factor in the race. If you look at the net worth of a white woman, she only has $0.50 and a black or Latino woman, I want you to guess. What do you think a black or Latino woman’s net worth is as compared to a white man? It’s going to blow your mind. I remember hearing that and I was like, “$0.10?” It’s less than a penny. For every dollar of net worth that a white man has, a black or Latino woman has less than a penny. I’m committed to changing and erasing that gap because I know and I believe truly that when women have that financial empowerment, then they will empower others.

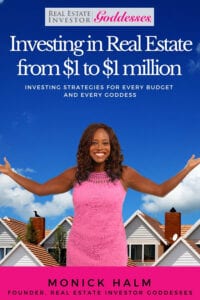

Time is a precious thing, and financial freedom gives you time because you no longer have to trade your time for money. Share on XI released a book, Investing in Real Estate From $1 to $1 Million: Investing Strategies for Every Budget and Every Goddess. As part of that book, I put in some facts about what is happening or what historically has happened for women around money. Women invest 40% less than men. Women only have $0.23 to the dollar of net worth than a man has, but this didn’t pop up. It’s not that we’re lazy or not wanting to invest. For a long time, we couldn’t. Did you know that women in many states were not allowed to have their own bank account until 1974? That year, the laws were changed so that women were able to own their own for the first time in many states, to have credit cards on their own, to have a mortgage and own property. In many states, they weren’t allowed to without the consent of a male relative. Until 1988 in many states, a woman could not open a business loan without the signature of a male relative. Until 1981, a husband could take out a second loan. He could mortgage their house without the woman knowing, that his wife was also on the property knowing.

Do you know what the origin of Mrs. is? It’s Mr.’s, as in belonging to the mister. Until 1900 in many places, when a woman got married, she became chattel, the property of her husband. She lost her citizenship and just became property. Everything that she had whether it was an inheritance and all her property, everything became his. She became his property and so did all of her stuff. There are historical reasons for this financial inequality. I’ll also talk about why it’s so much worse for people of color. In addition to all of those barriers to women having access to credit, banking facilities, her own money and being paid less than men, in 1974, if a woman was making $100,000 and the man was making the same income, they could count the woman’s income up to 50% less. They both make the same amount, but she would be given half the amount of credit. They would only count half of her income due to the assumption that she might have babies and stop working or something, but they wouldn’t treat them equally.

The REI Path

Investing in Real Estate from $1 To $1 Million: Investing Strategies for Every Budget and Every Goddess

If you add on the layer of race, redlining, and all of these race-based barriers to accessing credit, being able to buy property, getting mortgages, being able to buy in certain areas, and all of those things have led to these systemic inequities. Right now, it is possible with the right education for any woman to get into real estate. It is possible for us now, but a lot of us don’t even know what’s possible. Our families have not had real estate and property. We don’t even know to think about that as a possibility for ourselves. I didn’t. I never thought of that real estate investing as a possibility. It wasn’t something that I did and anyone in my family didn’t do. We bought our own homes. We did do that, but that was it. I never knew another way.

One of the things that I’m committed to as a real estate investor goddess is to showing and inviting women in and saying, “This is possible for you. Here’s how you do it. Here’s how you can get in.” The book that I wrote, Investing in Real Estate from $1 To $1 Million, shares different strategies that you can take to invest regardless of how much you make or have. There are three main excuses that I hear from women about why they can’t invest in real estate. A lot of them go, “I’d love to invest in the future. This is something I’d love to do in the future because people recognize that there’s value in real estate.” For Millennia, how wealth was created and transferred was through real estate. Ninety percent of millionaires become so through real estate. People recognize the value of the real estate, owning it and being an investor, but they think it’s not for them.

The main reason why they think that it’s not for them and they’re not able to do it is because they think that they need more money regardless of how much money they have. I was sitting in a bank, there’s always this like, “I don’t have enough yet.” They’re not quite sure how much it costs but there’s always this thought of, “It’s a lot more than I have access to.” I wrote my book in large part to answer that question or excuse. There are three excuses, but the first excuse is I don’t have the money. The title is Investing in Real Estate from $1 To $1 Million. I’ll share several strategies that are $0 strategies. There are strategies that don’t require any of your own money because I want that excuse out of your head. There are many ways to invest in real estate and there are multiple strategies that I share that is $0 and then one that’s not a $0. I know somebody who got into that strategy with $1 so it is possible to invest at $1. I share other strategies like $100 so you can start, plus several that are $0. I want that excuse, “I can’t get into this game because I don’t have the money,” out of your head. There is a way to get in.

Another excuse that I often hear, “I would love to do that but I’m so busy.” I get that because I’m busy too. I have two businesses, three kids, wife, travel, and speak. There’s a lot. There are ways that you can invest that take virtually no time. I share quite a few strategies that are passive and require little to no time. I want that excuse out of the way as well. Some of those are low cost too. If you’re thinking, “I don’t have time and I don’t have that much money either,” there are strategies that will work for you too. The last excuse that I hear is, “It would be great to have the money on the real state to be an investor, but I don’t want to get a call at 3:00 in the morning and deal with tenants or have to evict people,” dealing with all the three T’s: Tenants, Toilets, Termites.

Helping women achieve financial freedom is a shortcut to helping everyone. Share on XA lot of women are like, “I don’t want to do that. It will be great to own a property, to have passive income, but I don’t want the job of being a landlord.” I get it. I share strategies where you can invest and you don’t have to deal with tenants, toilets, and termites. You can invest and you don’t have another job. You can be an investor and not make it another side hustle. If you don’t have the hustle necessarily to do real estate, there are a lot of different ways to play in the game. Real estate investing is not one-size-fits-all. I share in this book different strategies that you can use because I know that every goddess has their own unique things that she’s interested in. What’s important depending on what I look at when I’m helping the goddesses in my program create their plan is where you are now. What are the resources you have?

Resources are time, money, relationships, experience, education. Where do you want to be? How do you want to play along the path? From knowing where you are, where you want to be, how you might like the play, we can create a plan for you that makes sense. This book that I’ve written is available for free if you go to REIGoddesses.com/free-guide. You can get a sense of twelve strategies that will give you an idea of how you can play in this game. It’s not comprehensive. There are more than twelve strategies to invest in real estate, but the main ones are represented there. My hope is you’ll see, “I can do this.” I want you to want to be financially free. That’s my goal. Getting the book, you’ll also be invited to free training on how to get started in real estate investing even as a busy professional woman. That will give you even more knowledge and empowerment towards that goal. That’s all I have for you.

Financial Independence For Women: It is possible now for any woman with the right education to get into real estate, but a lot of us don’t even know that’s possible.

Happy Financial Freedom Day. May we all live financially free. Thank you. If you want more information, go to REIGoddesses.com as always to connect with me and our amazing community of Real Estate Investor Goddesses. Also, please subscribe, so you don’t miss inspiring educational episodes. Please give it love. I love those five-star reviews. I love you to share it with others. This mission to help one million women, I know I can’t do that alone. All I can do is help those in front of me and inspire you to reach behind and help another woman too. Share this with other people. We’ll see you next time.

Important Links:

- Investing in Real Estate From $1 to $1 Million: Investing Strategies for Every Budget and Every Goddess

- REIGoddesses.com/free-guide

Love the show? Subscribe, rate, review, and share!

Join the Real Estate Investor Goddesses Community today: